Most businesses require some kind of equipment. However, purchasing equipment can be a significant expenditure of funds, particularly for industries that require a diverse range of assets. Renting or leasing equipment is a more cost-effective option to meet a company’s needs. And for a vast majority of businesses, the benefits of leasing equipment far outweigh the expenses of outright purchase. In this post, we’ll look at the distinctions between leasing and renting equipment and when buying is your best option.

Key Takeaways

- Equipment renting: Renting equipment is a better alternative when you only need the asset for a short time or when the business is unsure about the asset’s future use.

- Equipment leasing: Leasing equipment enables you to borrow equipment for a predetermined period. You agree to the terms with the equipment vendor, and once the contract expires, you return the equipment, renew the lease or purchase the equipment.

- Equipment buying: If you intend to use your equipment for more than five years and it retains its value well, you should consider purchasing it with a capital lease or a bank loan.

Leasing Equipment

A lease is a legally binding agreement between two parties with defined terms and conditions. The asset’s owner is known as the lessor, while the person who uses it is the lessee.

What Is Equipment Leasing?

Leasing allows you to reap some benefits of owning equipment while mitigating some drawbacks. An equipment lease is a sort of financing agreement in which the asset’s owner leases it to a contractor for a set monthly charge over a specified timeline. The lessee has the choice of extending the lease, acquiring the equipment, or returning it after the lease period. This way, you can avoid large down payments and reserve capital for other uses.

We did the research for you and compiled a list of the best 15 equipment management software solutions.

How Does an Equipment Lease Work?

Equipment lease agreements function similarly to rental contracts. You reach an agreement with the equipment provider, and when the contract expires, you either return the equipment, renew the lease, or purchase it.

Leasing Process

When applying for a lease, keep the following in mind:

- While applying for an equipment lease, ascertain that you have financial data for your business and its owners on hand.

- Your application is reviewed, and the lessor notifies you of the outcome.

- After acceptance, you must study the equipment lease agreement. After signature, you resubmit the documentation to the lessor, typically with the initial payment.

- Once the lessor receives and approves the completed documentation and the initial payment, you’ll receive a notification that the lease has begun. You may then take delivery of the equipment and begin any required training.

Operating Lease and Financial Lease

There are two broad types of leases:

Operating lease: An operating lease works more like a rent agreement. The lessor bears all ownership risk, the lessee reports no assets or liabilities, and the lease payments are reported as a rental expenditure in its income statement.

Given the nature of the contract, this lease usually has a term much shorter than the asset’s useful life.

Financial lease: The lessee bears the bulk of the risk associated with owning the asset under a finance lease. A finance lease is an acquisition of an asset that is financed through debt financing.

Typically, a finance lease will be for a period comparable to the asset’s expected life.

ToolSense is trusted by 700+ companies

Advantages of Leasing Equipment

Below are some of the benefits you can look forward to enjoying with equipment leasing:

- Lower initial cost: When you lease company equipment, you don’t have to spend a lot of money to get started.

- Tax deductibility: Lease payments can be deducted as business costs on your tax return, lowering your lease’s net cost.

- Flexibility: Contracts can be tailored to suit your specific requirements.

- Improved equipment upgradeability: Following the expiration of your lease, you have the option of leasing new, more advanced equipment.

Disadvantages of Leasing Equipment

Equipment leasing comes with its fair share of cons:

- Costlier in the long run: Renting an item is almost always more expensive than purchasing it.

- You don’t own the equipment: This lack of ownership is a big drawback, unless the equipment has become obsolete by the end of the lease.

- Payment obligation during the entire lease term: Even if you stop using the equipment, you are liable for lease payments for the remainder of the lease term.

Factors That Determine Monthly Lease Pricing

The following terms should be familiar to you in intended to assist you in calculating the equipment lease rates:

| Capitalized Cost | The price of the equipment after any down payment or trade-in allowance. |

| Residual | The value of the car after the lease period. |

| Depreciation | The amount by which the vehicle’s value has declined during the lease period. |

| Lease Term | The length of your lease (usually 2,3,4 years). |

| Money Factor | The monetary fee, typically expressed as a percentage. |

Equipment Lease Formula

Lease Payment = Depreciation + Interest + Tax

Depreciation: (Capitalised cost – Residual) ÷ Term of Lease

Interest: (Capitalised cost + Residual value) × Money Factor

Tax: (Monthly Depreciation Cost + Interest) × Local Sales Tax Rate

Renting Equipment

Renting and leasing work almost the same way except that with renting, you’ll sign a contract for a shorter time (usually less than a year), and won’t be responsible for maintenance fees. Additionally, you do not have the option of purchasing the equipment under this contract. After your rental period has expired, you must return the equipment.

What Is Equipment Renting?

Renting equipment offers you unmatched flexibility, allowing you to only pay for the asset you need when you need it. This strategy frequently favours smaller businesses, particularly subcontractors, who cannot afford the cost of equipment maintenance. Of course, this does not exclude the prospect of larger construction enterprises benefiting from renting under the right circumstances.

How Does Equipment Renting Work?

Renting equipment is less expensive than leasing because there is no large down payment required. Additionally, rental payments are sometimes considered a tax-deductible operating expense, which simplifies accounting. The best thing about renting equipment is you don’t have to worry about maintaining or repairing the property. Furthermore, because rental firms regularly update their inventory, you’ll nearly always be able to get your hands on updated or even brand-new equipment.

Qualification and Conditions for Renting

Some firms prefer to rent rather than lease because it allows them more flexibility if their circumstances change. When a business expands quickly, it may need to upgrade its equipment sooner than its lease allows.

Advantages of Renting Equipment

There are several advantages to renting equipment:

- Access to the best equipment: Having access to better equipment that would be too expensive to buy outright.

- Keep savings flowing: You don’t have to spend all of your savings or take out a loan to buy the asset.

- Forecast your cash flow: It’s easier to predict cash flow because interest rates on monthly rental charges are usually fixed.

- Equipment can be replaced at any time: It’s possible to upgrade or replace equipment.

Managing maintenance across an entire fleet is quite a challenge. Build custom workflows in our Asset Operations Platform to easily manage maintenance processes for thousands of assets.

Disadvantages of Renting Equipment

However, there are also some disadvantages to renting equipment:

- Better suited for short-term use: It can work out to be more expensive than if you bought the assets outright.

- Willingness to compromise on equipment model: Prepare to compromise with an equipment model that isn’t exactly what you had in mind.

Factors That Determine Monthly Rental Pricing

Several factors influence the cost of renting equipment, including the type and size of equipment required, as well as the period of the rental. Furthermore, charges vary widely depending on the local market and what is considered competitive in that area.

Buying Equipment

Ownership and tax benefits make owning company equipment appealing, but the high initial costs mean this option isn’t for everyone.

What Does Buying Equipment Mean, and How Does It Work?

Purchasing equipment refers to buying equipment in one lump sum payment or instalments. The corporation may purchase the asset with its funds or by outsourcing. Purchases also result in a shift in legal ownership.

Advantages of Buying Equipment

- Ownership: Owning the asset is beneficial for equipment with a longer useful lifespan and is unlikely to become obsolete soon.

- Tax breaks: The Internal Revenue Code’s Section 179 allows you to deduct the entire cost of some newly acquired assets in the first year.

- Allowance for depreciation: While not all equipment purchases qualify for Section 179 treatment, practically any business can benefit from depreciation discounts.

Disadvantages of Buying Equipment

Like leasing, purchasing has its drawbacks:

- Higher initial cost: Due to the initial financial expenditure, purchasing business equipment may not be an option for some people.

- Risk of outdated equipment: When you buy high-tech equipment, you run the risk of it becoming technologically obsolete, forcing you to spend on new equipment much sooner than you intended.

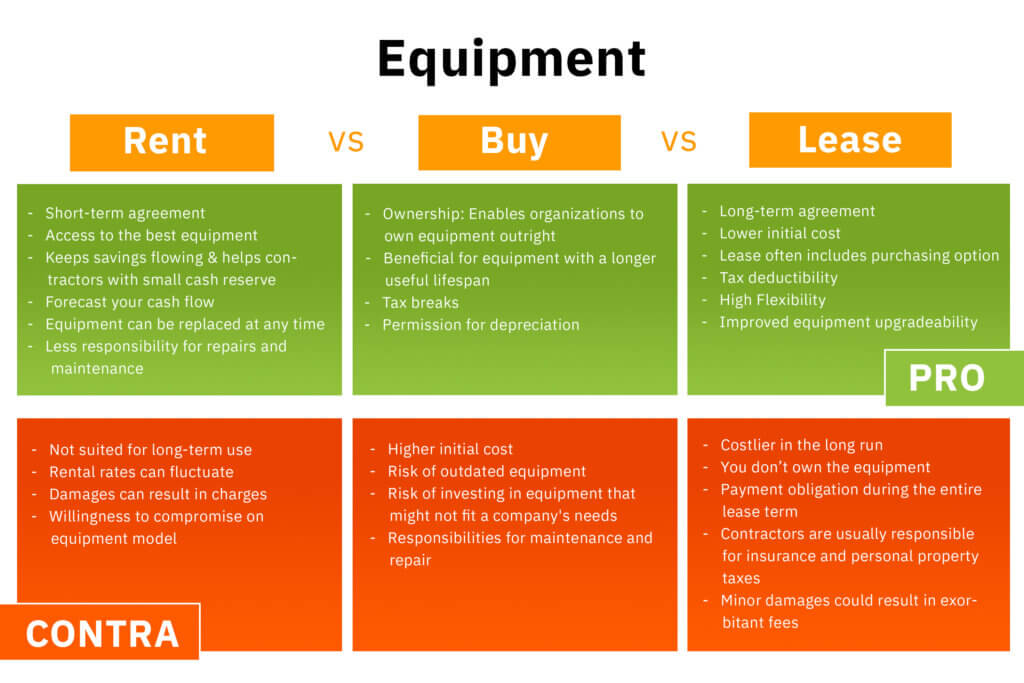

Rent vs Buy vs Lease Equipment

Renting equipment means less down payment and less money spent on the overall arrangement than leasing. Renting is a better option when you need the asset for a short time or when the business is not sure about the future use of that particular asset.

Leased equipment, on the other hand, allows you to avoid significant down payments and save much-needed funds. You will, however, generally pay a greater interest rate than if you purchased the equipment outright.

Buying equipment affords you the privileges of ownership and tax benefits. Purchasing equipment that will be used regularly, if not daily, is highly recommended.

Should You Rent, Lease or Buy?

Choosing whether to rent, buy, or lease equipment requires careful evaluation of various variables and circumstances. For instance, a company that manufactures hardware should lease equipment rather than rent it. Leasing equipment will also mean no hefty down payments, reserving funds for other needs. Renting, on the other hand, is appropriate for companies that need equipment for a short time or are unsure about its future use, especially for one-time use or seasonal contracts. Buying equipment is the better option if a company plans to use it for an extended period (more than five years) and the equipment retains its value well.

Conclusion: ToolSense Has Your Back – No Matter If You Rent, Lease or Buy

ToolSense offers a comprehensive asset management solution that is suitable for all industries, including construction, agriculture, manufacturing, education, and more. The cloud-based software allows companies to add existing equipment lists via Excel import and extend the list whenever new equipment is added. This goes for rented or leased equipment as well as assets directly owned by the business.

Each asset receives an individual lifecycle folder that stores vital information, such as usage, downtime, maintenance history, work orders, photos, invoices, or other files directly related to the equipment, including leasing or rental agreements. This allows employees to access relevant information at any given time – from anywhere. Because ToolSense is a cloud-based service, managers and staff can access files either through a desktop application or a mobile app.

Companies can keep up with all vital maintenance tasks thanks to ToolSense, regardless of whether a piece of equipment is owned, rented, or leased. Maintenance managers can set up individual maintenance intervals for each asset, either according to usage, date, or other data collected by modern IoT sensors. ToolSense also offers the ability to create custom checklists for each machine, making it impossible for maintenance workers to overlook upcoming tasks. They will receive a useful reminder whenever an audit is due, ensuring that the equipment is in top condition at all times.

By utilising ToolSense’s asset management solution, companies can extend the useful life of critical equipment, save money by implementing preventive or predictive maintenance schedules, and become more efficient due to time-saving work order management. Additionally, business owners gain a better understanding of existing equipment through reporting and analytics features and can make more informed decisions about their owned, leased, or rented equipment in the future.

See How ABM Improved Their Equipment Management With ToolSense

FAQs About Renting vs Buying vs Leasing Equipment

Renting equipment is a straightforward process. However, before renting anything, take the time to research and analyse local rental services. Rent wisely and inquire about the rental agreement to ensure that you understand it completely. Ascertain that you understand the agreement’s maintenance component. Once you’ve received answers to your queries and are sure that you’ve chosen the best rental company for your needs, sign the agreement to rent the equipment.

To lease equipment, you must first fill out an equipment lease application, which will take about 48 hours to get a reply. After receiving approval, you must carefully review the leasing agreement before signing.

Equipment leasing is a type of finance in which small business owners rent instead of purchasing equipment. The equipment is leased for a set time. When this period expires, the business owner must decide whether to return the equipment or renew the lease. Leasing equipment, like a company loan, requires paying interest and fees. Insurance, maintenance, repairs, and other connected costs may incur additional charges.

Leasing capital equipment frees up funds for other financial demands. Alternatively, if your industry is rapidly evolving and your current equipment becomes obsolete every few years, leasing equipment is a viable choice.

Leasing equipment offers lower upfront costs and flexibility, but may cost more in the long run. Buying provides ownership and potential savings over time, but requires higher initial investment and maintenance responsibilities. Choice depends on financial goals and usage needs.

What Are the Disadvantages of Leasing Equipment?

Leasing equipment can be costlier overall, lacks ownership benefits, and restricts customisation. Contracts may have hidden fees and penalties for damage. Long-term expenses can surpass buying.

The primary reason for renting or leasing equipment is to minimize upfront costs and conserve capital. This allows businesses to access necessary resources without large initial investments, maintaining financial flexibility and focusing resources on core operations. Additionally, businesses remain more flexible and can upgrade their equipment when needed instead of being tied to long-term investments.

Contractors should weigh factors like project duration, equipment frequency, maintenance costs, and resale value. Short projects might favour renting for flexibility, while frequent use could justify buying or leasing for long-term savings and customisation.