How do you ensure your organization’s assets deliver maximum value over time? The key lies in understanding the lifespan and depreciation of these assets. Imagine a scenario where your machinery and equipment not only serve you longer but also save significant costs.

ToolSense is trusted by 700+ companies

By mastering the art of extending the useful life of assets and calculating depreciation accurately, companies can not only enhance performance but also optimize financial planning. This article delves into the nuances of asset lifespan, from determining the useful life to different methods of calculating depreciation, guiding you towards smarter asset management.

Key Takeaways

- Organisations need to understand the useful life of assets for safe and optimal operation.

- Various methods of calculating depreciation allow companies to determine and accelerate depreciation.

- Enhanced tracking and monitoring can help warn you when maintenance is required to extend the useful life of your assets.

Understanding the Useful Life of an Asset

What is the useful life of an asset? The useful life of an asset, also known as economic life or service life, is an estimate of how long you can reasonably expect to use an asset for the benefit of your organisation. It also tells you how long the asset will remain functional and generate income. The useful life definition will vary depending on the type of asset and how many years make up the asset’s lifespan.

When considering an asset lifecycle for business assets, depreciation also plays an important role.

What Is Depreciation?

Depreciation is an accounting method to spread the cost of an asset over its useful life. This allows organisations to allocate the price paid for depreciating assets over the length of time it is in use rather than at the time of purchase.

In other words: useful life and depreciation indicate how long you have before a significant investment is required to replace critical assets.

What Is the Difference Between Fixed Assets and Tangible Assets?

There are two classes of assets: tangible and intangible. Tangible assets include physical assets and property while intangible assets don’t physically exist, but have monetary value, such as goodwill or copyrights that produce royalties.

Fixed assets are long-term tangible assets, such as buildings, machinery, cars and trucks, furniture, and computer equipment.

Importance of Understanding an Asset’s Useful Life

Understanding an asset’s useful life is important for several reasons.

For financial planning and tax purposes, fixed assets can be depreciated over their useful life to reduce the amount of taxes companies pay.

Useful life estimates can also help organisations make decisions about whether to continue to maintain equipment or replace it. For example, when the cost of maintaining equipment exceeds the asset’s value and no longer provides a significant tax advantage, organisations may decide it is time to replace the asset.

Knowing the expected lifespan of an asset can also help you with safe operation. If you know a piece of equipment, for example, has a useful life of 10 years, you may want to invest more in maintenance as it reaches the end of its useful life.

Even after an asset reaches the end of its useful life, it may still have value and remain in use for years to come. What expires is your ability to claim the depreciation of a fixed asset from a financial and accounting perspective.

Managing your assets shouldn’t be hard. That’s why Excel, WhatsApp or Pen & Paper are not the right tools to efficiently manage your asset operations. No matter the manufacturer or type—with ToolSense you are good to go.

How to Determine the Useful Life of an Asset

Businesses can use several different ways to determine asset life expectancy, including:

- Manufacturer specifications

- Past experience using similar depreciating assets

- Standard industry practices

- Engineering estimate

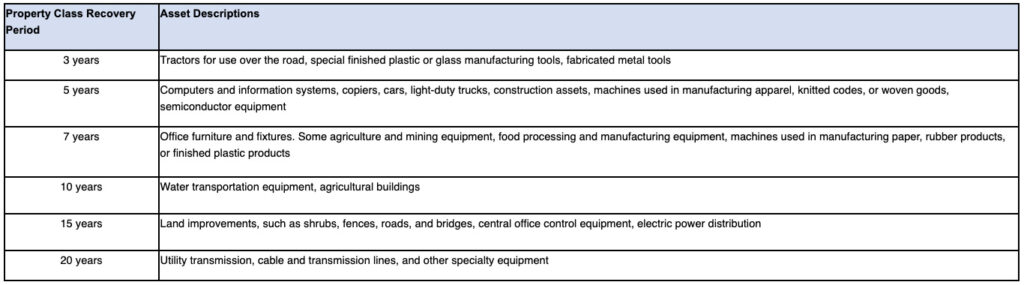

For most tangible assets, the IRS also provides useful life estimates that you can use in lifespan asset management. Appendix B of IRS Publication 946 provides a capital asset useful life table you can consult. It lists the class life of different types of assets and the recovery period in years.

You may also be able to make annual adjustments to your asset lifecycle management at any time before asset disposal.

Factors that Affect the Useful Life of an Asset

A significant factor in assessing an asset’s useful life is the type of asset. Some assets have longer useful lifespans than others. For example, the IRS classifies computers, printers, and copiers as having a 6 year useful life (eligible for depreciation over five years). Office furniture, such as desks, is classified for 10 years (eligible for deprecation over seven years). Making land improvements to your property such as adding a fence or sidewalks is classed as a 20 year asset (eligible for depreciation over 15 years).

Other factors that play a role in an asset’s useful life include:

- The asset’s condition

- Pattern and frequency of use

- Technology

- Compliance regulations

- Where and how the asset is deployed

ToolSense is trusted by 700+ companies

How to Calculate Depreciation

There are multiple ways to calculate the depreciation of fixed assets. The most common way is straight-line depreciation.

Straight-line Depreciation

Here is an example of straight line depreciation. Let’s say you are calculating the depreciation for a tractor for lawn mowing that you use to maintain your property. Looking at the IRS chart under machinery depreciation life, you would see the useful life listed as 10 years for machinery and equipment.

To calculate the depreciation, you need to know the purchase cost at acquisition and any salvage cost after the end of the asset’s life.

Straight Line Depreciation Formula

(Purchase Price – Salvage Value) / Useful Life = Annual Depreciation

In this example, the tractor was purchased new for $20,000 and the expected salvage value at the end of its life is $5,000. Using the straight-line depreciation method, your calculation would be:

($20,000 – $5,000) / 10 years = $1,500 per year

With straight-line depreciation, you are spreading its cost evenly over the asset’s life. You can also choose accelerated depreciation. While the overall amount of depreciation remains the same, how quickly the depreciation is recognised changes.

Accelerated Depreciation

With accelerated depreciation, you can deduct more of the asset’s value in the early years while the asset is in service and lowering expenses as assets age. There are also two ways to calculate accelerated depreciation. The most common ways are the sum of the years’ digits (SYD) method and the double-declining balance method.

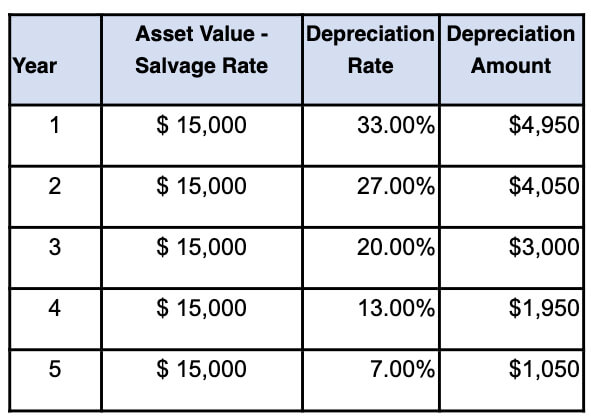

SYD Method of Accelerated Depreciation

To calculate accelerated depreciation using the SYD method, let’s use construction equipment depreciation life as an example. The IRS allows assets used in general building construction to depreciate over five years. If an asset was purchased for $20,000 with a salvage value or selling price at the end of the depreciation period of $5,000, the total depreciation for the term would be the same as using the straight-line depreciation method of $15,000.

However, instead of taking the $15,000 depreciation equally over the five years, companies can accelerate depreciation using the SYD Method. In this case, you take the sum of the year (1 + 2 + 3 + 4 + 5 = 15). Then, you can claim depreciation based on a percentage of the whole. So, for the first year, you would claim depreciation of 5/15th (or 33%) of the total. Then, in the next year, you would claim 4/15th (or 27%) and so on. It would break down like this:

As you can see, the total amount of depreciation remains the same ($15,000), but organisations can accelerate it using the SYD method.

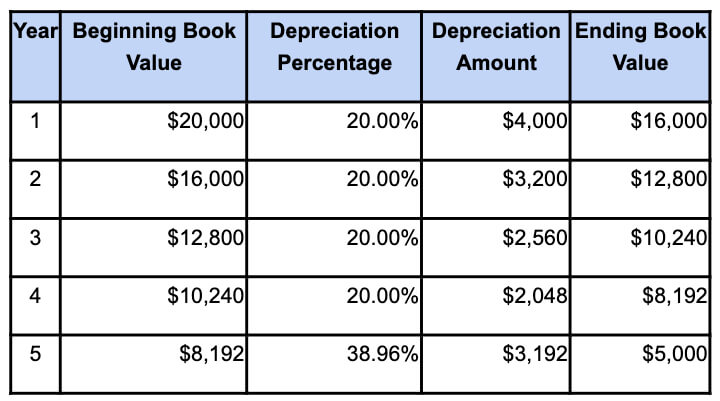

The Double Declining Balance Method of Accelerated Depreciation

The double declining balance method takes a slightly different approach to calculating depreciation. First, you need to determine the depreciation rate. With a five-year depreciation, your rate would be 1/5th or 20%. You would take 20% of the beginning balance for each of the first four years and then calculate the remaining depreciation in the final year to get to the total amount.

You then multiply the depreciation rate times the book value at the beginning of each of the five years to determine the annual amount of depreciation you can claim. Here’s how it would break out using the same example of an asset worth $20,000 on a five-year depreciation schedule.

Useful Life Estimate of Fixed Assets

Per the IRS, here are the guidelines for various types of asset classes and how many years you can claim for depreciation. Of course, many assets stay in use and have a lifespan far exceeding their expected useful life or the length of time you can claim depreciation.

For example, office furniture can be depreciated over 10 years, but might still be in service 20 years from now. Cars, machines, and tools often outlive the depreciation period, especially if they are properly maintained.

Best Practice for Extending the Useful Life of Critical Assets

Organisations looking to extend the useful life of critical assets can take several steps. It starts with buying the right assets. It can be tempting to buy cheaper assets, but the useful life will be shorter. Buying high-quality items will simply last longer.

The most important thing you can do to extend the useful life of critical assets is to follow a regular maintenance schedule following the manufacturer’s recommendation. Proactive maintenance or preventive maintenance keeps assets in peak performance. Using tools like ToolSense can help you keep track of when maintenance is due.

Best Practices are:

- Buying the right asset

- Proactive maintenance

- Machine operator training and training for employees

- Following OEM guidelines

- Using original spare parts

- Using smart asset and equipment management software

How ToolSense Can Help

With ToolSense, you can manage and inventory your assets, devices, and equipment with QR codes and digitise machines with IoT, so you can know where devices are at all times and monitor them for errors. This makes it simpler to keep track of all of your assets and makes servicing them more transparent.

Each asset has its unique code, which lets you create and keep history. Service tickets, maintenance and repairs, and reminders are all in one place. You can also store standard documents, test reports, images, or videos.

ToolSense makes it easy to capture and process equipment and machine tickets and automatically forward them to the right department or manufacturer for repairs. Operators just scan the ToolSense QR codes, report problems with a few clicks, and attach a photo. This generates a digital ticket and notifies the right person. ToolSense manages the entire service ticket process, which can then be assigned for remediation. Once a repair is complete, the service case is automatically appended to the machine’s history. You can also define rules, such as maintenance, testing, or inspection intervals. Reminders can be triggered by calendar dates or by IoT data based on preset usage limits.

With IoT devices, you can also track any kind of machine to monitor equipment health, such as location, run time, battery voltage, load, and vibration. This helps you know when assets are approaching a critical number of hours that require preventative maintenance. ToolSense AMP lets you collect additional performance data about specific components within a machine with a visual dashboard showing how the load of each component behaves.

To learn more about how ToolSense can help your organisation, schedule a digital tour with our team. You can test your fleet and see first-hand how ToolSense simplifies your processes and can help extend the life of your critical assets.

See How ISS Improved Their Asset Processes With ToolSense

FAQs

To determine the life of an asset, you need to take into account its age, the frequency of use, and your business conditions. The IRS publishes guidelines to help with your estimations.

Short-term assets have a lifespan of less than a year. They include items such as cash, cash equivalents, and accounts receivable. Fixed assets such as computers and software also have lifespans of about three to five years.

Assets such as land, buildings, furniture, and machinery have long lifespans, ranging from five to 50 years,

For calculating asset depreciation, you should consider part experience with similar assets, industry practice, and engineering estimates.