Have you ever wondered how businesses keep track of all their valuable equipment, from the smallest tool to the largest machine? Imagine a library, but instead of books, it’s filled with everything a company owns. This is what an asset register is – a critical tool for managing business assets.

Just like a librarian keeps a detailed record of every book, an asset register maintains a comprehensive database of each asset, its location, value, and history. It’s not just about knowing what you have; it’s about maximizing the use and lifespan of every item in your business arsenal.

Short Summary

- Asset registers are comprehensive databases that help businesses manage their assets and maintain accurate financial records.

- Creating an effective asset register requires essential information, such as asset description, location, purchase date, value, and maintenance history

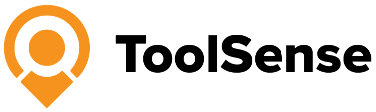

- Best practices for maintaining accuracy include eliminating spreadsheets & creating SOPs.

- Leverage technology to save time and money with ToolSense’s specialised software for efficient asset management and tracking.

What Is an Asset Register, and Why Is It Important?

An asset register is a comprehensive database that streamlines effective financial management of business assets, reduces unnecessary costs, extends the operational life of assets, and assists with various asset compliance and tax matters. The significance of an asset register is indisputable – it deters theft or misplacement, ensures precise financial records, and assists businesses in sustaining accurate financial records and maximising asset utilisation. Creating an asset register requires you to identify all your assets, assign unique tags or codes, and record their details in a centralised system.

Monitoring fixed assets provides increased visibility, control, and accountability, leading to reduced purchases, fewer losses, and the maintenance of accurate tax and insurance information. Regular maintenance of assets can help prolong their useful life and reduce costs associated with asset replacement and repair. A physical audit is essential for capturing accurate data that is stored in a business’s equipment register.

Proper asset register maintenance can help businesses accurately estimate the salvage value of their assets, which is the estimated resale value of an asset at the end of its useful life.

Expert advice

Staying ahead of all requirements for an accurate asset register can be quite a challenge. Using an asset operations platform like ToolSense ensures a compliant and flawless operation of your assets.

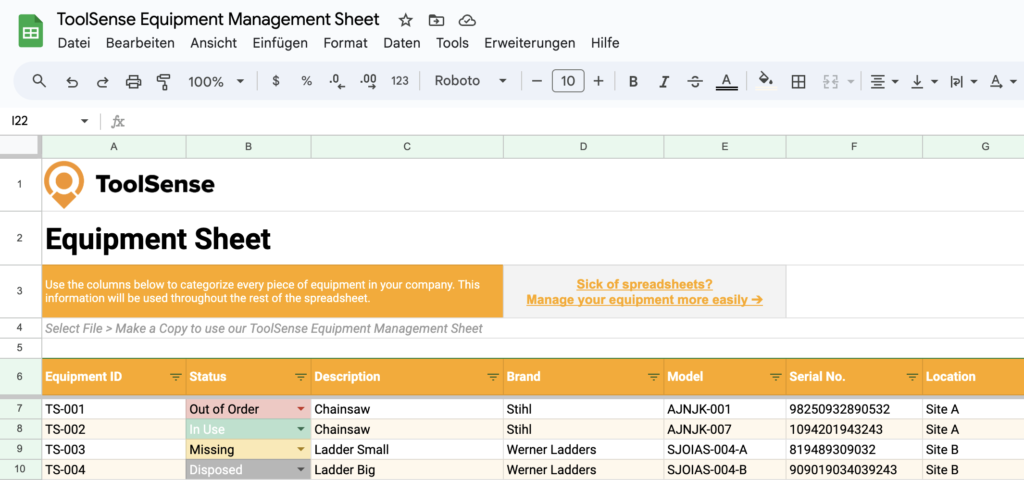

Types of Asset Registers: Fixed and Digital

Asset registers can be tailored to the type of asset, with small businesses typically having one register containing data on all assets, while larger companies may have up to three registers, including one for IT and digital assets. A fixed asset register is used to track tangible assets, with the scope of assets dependent on the capitalisation policy of the business. For example, assets with a value of more than $2,000, such as company vehicles, may be included in the register. Utilising a fixed asset register template can help streamline this process for businesses, while fixed inventory registers can be customised to suit the specific needs of the organisation.

On the other hand, a digital asset register typically includes details such as inventory description, location, format, and ownership or copyright status. Asset tags can simplify the audit process by enabling workers to scan assets on-site and rely on the system rather than manual checklists. Digital equipment registers can further streamline this process by providing a centralised, easily accessible platform for managing and tracking assets.

Key Components of an Effective Asset Register

An effective asset register provides essential information such as equipment description, location, purchase date, value, and maintenance history. To accurately identify assets for a successful register, a list of fixed assets on the balance sheet and conducting a physical audit are the two primary approaches. Implementing a system to eliminate spreadsheets, establishing standard operating procedures (SOPs), categorising assets based on their criticality (asset hierarchy), and devising an intuitive labelling system are all recommended approaches to maintain equipment register accuracy.

Creating Your Asset Register: A Step-by-Step Process

Embarking on the journey to create an asset register may seem daunting, but by following a step-by-step process, you can streamline the task and ensure accuracy. In the upcoming sections, we’ll explore each step in detail, including setting a capitalisation policy, choosing the right asset management software, conducting a comprehensive asset audit, establishing unique asset tags and codes, as well as periodically updating and monitoring the asset and equipment register.

Setting an Asset Capitalization Policy

An asset capitalisation policy is a set of criteria that determine the minimum value threshold for including assets in the register, thereby guaranteeing uniformity and adherence to regulations. For small businesses, the minimum value threshold is typically set at $500. This ensures that only assets meeting a certain value criteria are included in the asset register, providing consistency and compliance across the organisation.

In contrast, enterprise-level organisations often maintain a capitalisation policy of $5,000 or more for their more expensive equipment. By setting an appropriate capitalisation policy for your business, you can ensure that the right assets are included in your asset register, contributing to its overall accuracy and reliability.

Choosing the Right Asset Management Software

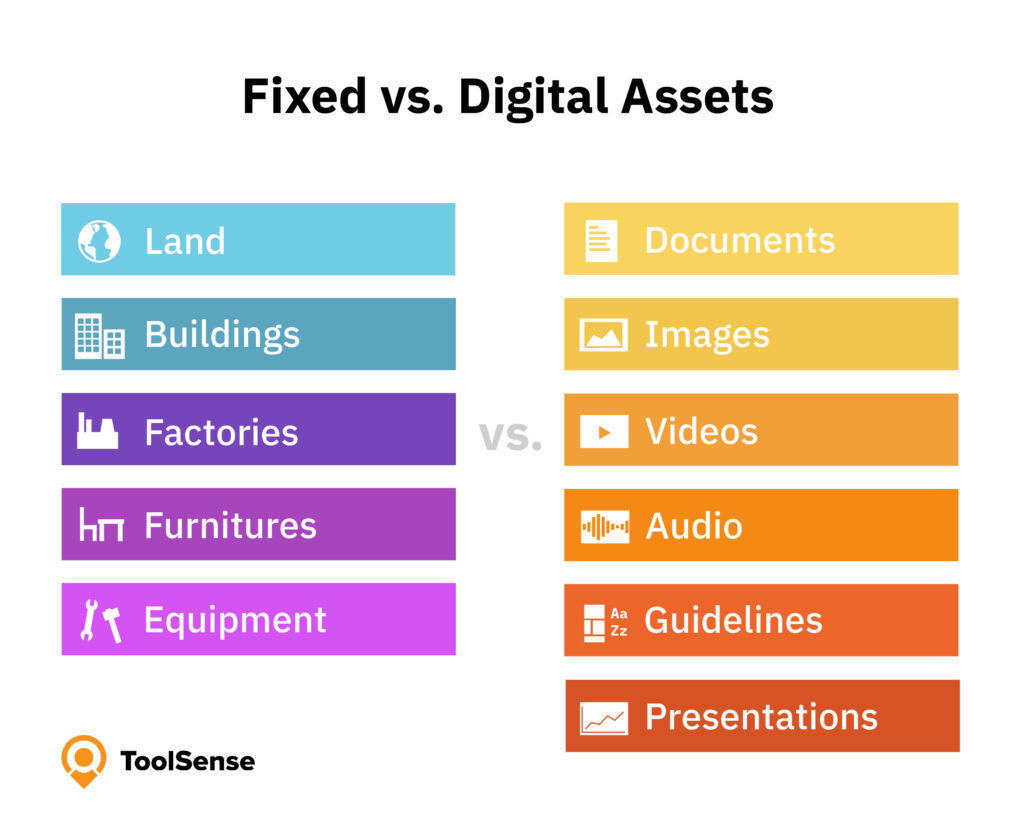

Selecting the appropriate asset management software facilitates the procedure of creating and maintaining an accurate asset register. Asset management or asset tracking software is a specialised system that enables organisations to categorise and track their physical assets in real-time, assisting with the management of asset lifecycles, tracking asset availability and monitoring asset utilisation.

With ToolSense, companies receive a comprehensive asset management solution that can be used for a variety of assets regardless of type or manufacturer. The cloud-based software can be accessed from stationary desktop computers or from mobile devices thanks to the ToolSense app. This allows employees access to vital information regardless of location, enabling them to work from their desks, remotely, or directly next to the asset in question – whether it is stationed in a factory or at a construction site. Each asset is assigned an individual lifecycle folder that stores vital information, such as asset and maintenance history, related work orders and documents, warranty information, or even photo and video material. Additionally, the included reporting and analytics functions provide profound insights into every single asset, making ToolSense a comprising solution for companies in various industries.

ToolSense is trusted by 700+ companies

Conducting a Comprehensive Asset Audit

A comprehensive asset audit is crucial in identifying all assets, verifying their information, and guaranteeing precise data entry in the register. An asset audit is a process of physically reviewing and verifying all the assets of a company or organisation to ascertain their existence, condition, and value. It assists in providing an accurate representation of the company’s possessions and evaluating the sufficiency and efficacy of the organisation’s asset management controls.

The steps for conducting an asset audit involve identifying all assets, verifying the information associated with each asset, recording the information in the inventory records, and updating the asset register periodically. To ensure a successful audit, it is suggested to establish a standard operating procedure (SOP) for conducting the audit, identify critical and non-critical assets, create an intuitive labelling system, and leverage technology for efficient asset management.

Establishing Unique Asset Tags, Codes and Labels

Establishing unique asset tags, codes, and labels is essential in facilitating the identification and tracking of assets. Modern Internet of Things (IoT) technologies, such as QR codes, barcodes, RFID or NFC, can be used in connection with asset management software to make the process even more efficient and to further automate workflows. These tags can contain information such as the asset’s serial number, purchase date, and owner, and can be utilised for tracking asset location, monitoring asset usage, verifying asset ownership, tracking maintenance history, and reducing asset theft.

By assigning unique tags, codes, and labels to each asset, businesses can ensure easy identification, tracking, and management of assets, contributing to the overall accuracy and efficiency of their asset register.

Update and Monitor the Asset Register

Maintaining regular updates and monitoring the asset register is essential for its accuracy and dependability. Utilising asset tracking software is recommended to facilitate this process. Tracking and monitoring the inventory records by assigning unique asset tags, codes, and labels to each asset ensures the register remains up-to-date and accurate.

To guarantee optimal relevance, it is recommended to review the asset register at least annually; however, for the best results, it should be reviewed every six months. By regularly updating and monitoring the inventory register, businesses can ensure the accuracy and reliability of their asset management processes.

Best Practices for Maintaining Asset Register Accuracy

Maintaining an accurate asset register is critical for effective asset management. In this section, we’ll delve into the best practices for ensuring inventory register accuracy.

Eliminate Spreadsheets

Spreadsheets can present a risk of errors and inefficiencies, potentially compromising data accuracy and resulting in data loss. Utilising spreadsheets for asset register maintenance can result in errors, difficulty in handling a substantial number of assets, and lack of required security features to safeguard sensitive asset information.

To ensure the accuracy of your register, it is recommended to eliminate spreadsheets and use dedicated asset management software instead. By forgoing spreadsheets and implementing dedicated asset management software, you can significantly reduce the risks associated with errors and inefficiencies, ensuring a more reliable and accurate asset register.

Create Standard Operating Procedures (SOPs)

Establishing standard operating procedures (SOPs) for asset tracking and management ensures consistency across the organisation and can greatly improve the overall accuracy of your asset register. An SOP for registry tracking is a set of standard operating procedures that all personnel responsible for managing the equipment register must adhere to, guaranteeing uniformity and precision when updating parameters such as asset location, asset status, or maintenance status.

Developing and sustaining an SOP for registry tracking involves designating explicit roles and duties for asset tracking, articulating the asset tracking process, designing a system for tracking assets, constructing a system for monitoring and refreshing the asset register, developing a system for reporting and auditing the asset register, and establishing a system for archiving and disposing of assets. By implementing these procedures, businesses can ensure consistent and accurate asset tracking and management across their organisation.

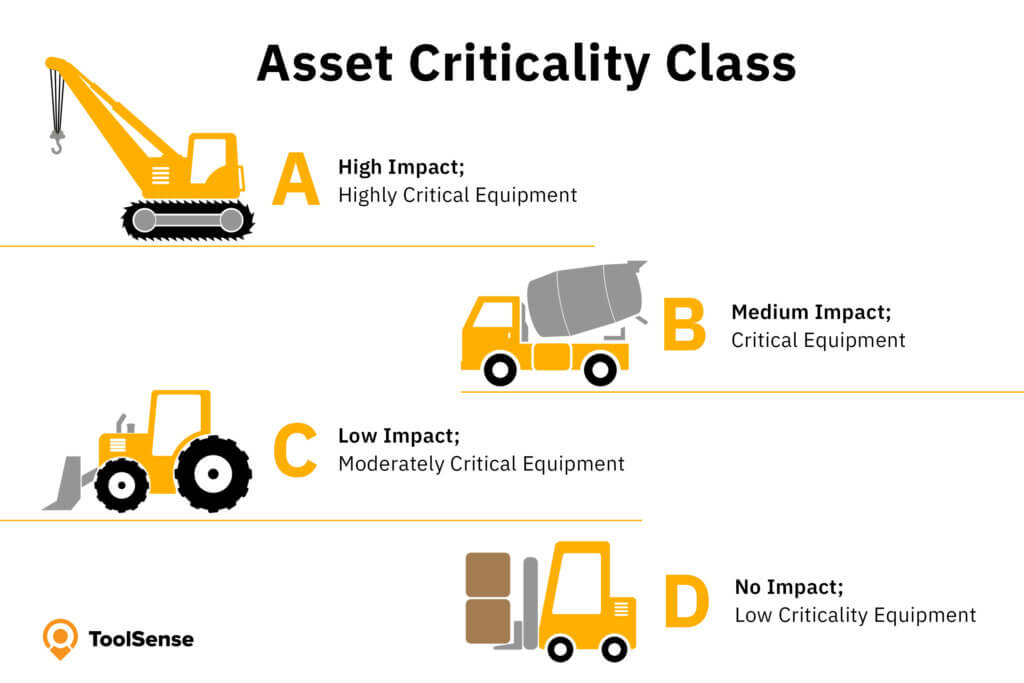

Identify Critical and Non-critical Assets (Asset Hierarchy)

Differentiating between critical and non-critical assets is an essential aspect of prioritising maintenance and updates, ultimately improving overall asset management. An asset hierarchy is a structured approach for cataloguing all the machines, equipment, and individual components owned by a company in one or more locations, providing a comprehensive index of all maintenance equipment, machines, and components, and how they interact.

The asset hierarchy can help maintenance teams identify and prioritise maintenance tasks, replacement parts, preventive maintenance, corrective maintenance, and other necessary steps to ensure the asset is functioning properly. By identifying critical and non-critical assets, businesses can optimise their asset management processes and focus resources on the most important assets.

Create an Intuitive Labelling System

Establishing an intuitive labelling system for assets can simplify identification and tracking, leading to fewer errors and increased efficiency. An intuitive labelling system is one that is designed to be easily understandable and straightforward, requiring minimal explanation or training for users to utilise it.

By implementing a labelling system, businesses can facilitate the identification of assets and enable more efficient tracking and monitoring, thereby contributing to the overall accuracy and reliability of their asset register.

Leveraging Technology for Efficient Asset Management

Embracing technology can significantly improve the efficiency and accuracy of asset management. Cloud-based accessibility of data enables editing on various platforms, such as desktops, tablets, and mobile devices, at any given time, providing a single source of accurate information. Asset management software, such as ToolSense, offers features like asset monitoring, mobile device management, asset tracking, and lifecycle management, providing a comprehensive solution for effective asset management.

Additionally, asset tracking devices allow for automatic updating of asset information, including location, without manual data entry. By leveraging technology and investing in sensors and tracking systems, businesses can provide constant, 24/7 visibility of expensive machinery and vehicles with higher mobility as well as increased wear and tear, ensuring efficient and accurate asset management.

Addressing Common Challenges in Asset Register Maintenance

Common challenges include:

- inaccurate data,

- human error,

- theft,

- and difficulty in tracking assets.

Addressing these challenges is crucial for maintaining an accurate and reliable asset register. A system of checks and balances should be implemented, including double-checking entries, using automated systems to track assets, and conducting regular audits.

Ensuring the accuracy of the asset register can be achieved by routinely reviewing it and making necessary adjustments, such as adding new assets and removing obsolete ones. By addressing these common challenges and implementing the best practices discussed in this blog post, businesses can maintain an accurate and reliable equipment register, optimising their asset management processes and reaping the benefits of reduced costs, improved compliance, and optimised asset utilization.

Conclusion: Save Time and Money With Asset Register Software From ToolSense

Investing in ToolSense’s asset management software can save time and money by streamlining asset tracking, improving accuracy, and optimising asset utilisation. With features such as asset monitoring, mobile device management, asset tracking, and lifecycle management, ToolSense provides a reliable and cost-effective solution for your business’s asset management needs – regardless of industry or sector and the type of asset that is managed. Our ROI calculator dives deep into your current processes & calculates how much you could save with the ToolSense Asset Operations Platform.

By incorporating the best practices and leveraging technology discussed in this blog post, your business can maintain a highly accurate asset register, paving the way for efficient and effective asset management, ultimately leading to cost savings and improved compliance.

ToolSense is trusted by 700+ companies

Frequently Asked Questions

To keep an asset register consistently accurate, businesses should regularly update depreciation values, track assets in real-time with equipment tagging solutions, as well as update usage and condition ratings using an asset management software like ToolSense.

A fixed asset register is a record of tangible assets such as land, property, machinery, vehicles, office equipment, and tools. It provides an organised system for tracking and maintaining accurate information about the company’s assets.

An asset register is a comprehensive database that helps businesses manage their assets, reduce costs, extend the life of their assets and meet compliance and tax requirements. It can help businesses track the location, condition, and value of their assets, as well as the associated costs and liabilities. It can also provide insights into the performance of assets and help businesses make informed decisions about asset management.

An effective inventory record should include asset description, location, purchase date, value, and maintenance history for a complete record.

Technology can greatly enhance asset management by streamlining tracking processes, providing real-time data, and automating updates. This leads to increased efficiency and accuracy in asset management.

This article was generated using AI technology and edited and fact-checked by our editorial staff.